Portfolio Data

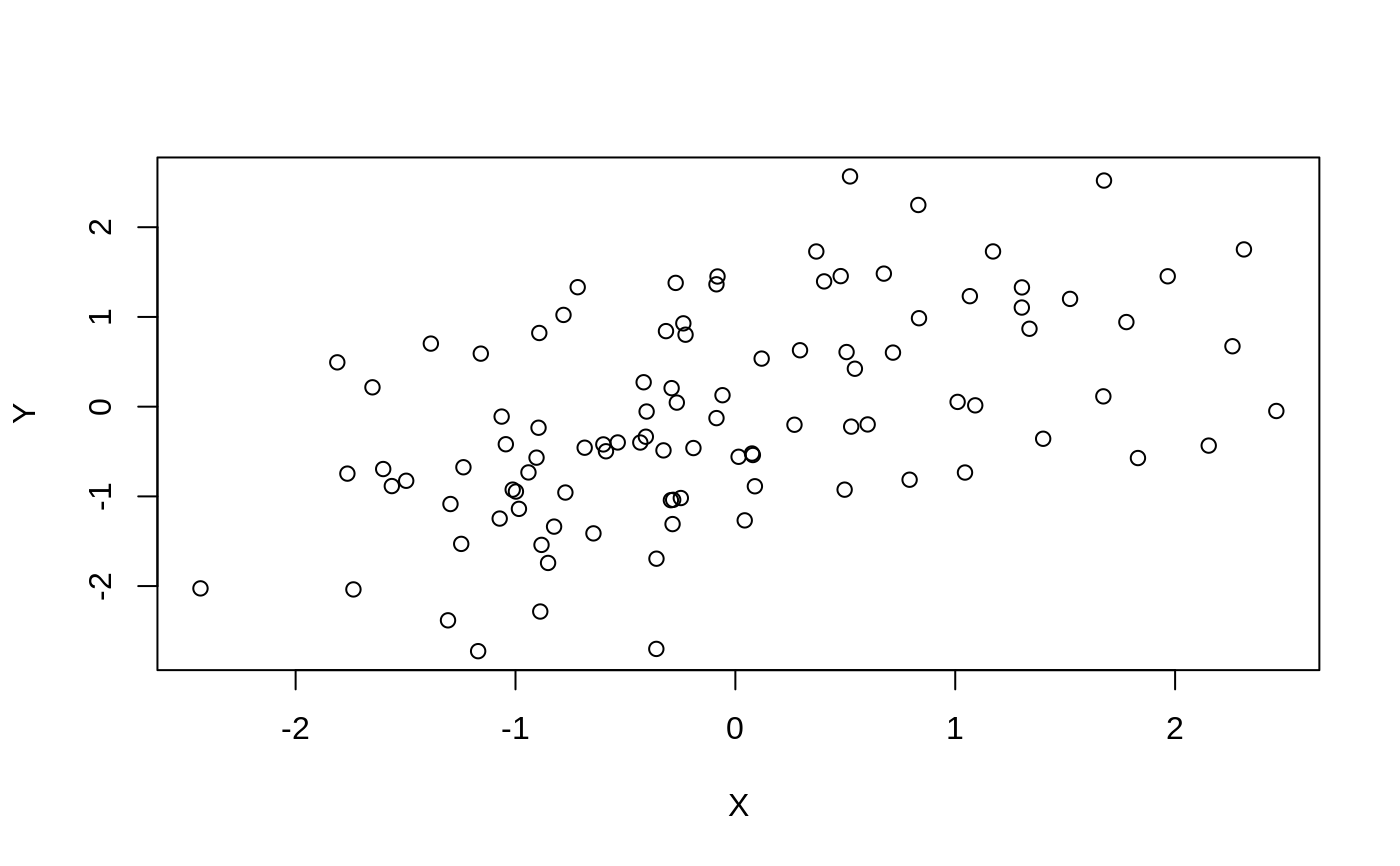

Portfolio.RdA simple simulated data set containing 100 returns for each of two assets, X and Y. The data is used to estimate the optimal fraction to invest in each asset to minimize investment risk of the combined portfolio. One can then use the Bootstrap to estimate the standard error of this estimate.

Portfolio

Format

A data frame with 100 observations on the following 2 variables.

XReturns for Asset X

YReturns for Asset Y

Source

Simulated data

References

James, G., Witten, D., Hastie, T., and Tibshirani, R. (2013) An Introduction to Statistical Learning with applications in R, www.StatLearning.com, Springer-Verlag, New York

Examples

summary(Portfolio)#> X Y #> Min. :-2.43276 Min. :-2.72528 #> 1st Qu.:-0.88847 1st Qu.:-0.88572 #> Median :-0.26889 Median :-0.22871 #> Mean :-0.07713 Mean :-0.09694 #> 3rd Qu.: 0.55809 3rd Qu.: 0.80671 #> Max. : 2.46034 Max. : 2.56599